Alacrita frequently supports companies with their search and evaluation activities. Our scouting support is often structured to integrate with a client’s internal efforts to generate a flow of new and exciting opportunities. The below was prepared by our asset scouting team.

What is asset scouting?

Simply put, it is a search to identify and evaluate pharmaceutical assets or partners for in-licensing or acquisition opportunities. In reality, asset scouting is an exhaustive search of:

- commercial, grant, and internal databases;

- company pipelines;

- deprioritized assets from big pharma;

- scientific literature;

- conference presentations and abstracts;

- intellectual property (including unpublished patents);

- startup or business partnering events;

- liaising with university or foundation technology licensing offices (TLOs), key opinion leaders (KOLs), and investors to identify in-licensing opportunities.

Sounds exhausting? Well, it can be for a small BD group, and the costs associated with gaining access to databases of innovative assets ($40K - $60K USD/year) or hours spent searching for assets and building relationships with companies, investors, KOLs, and TLOs are not insignificant.

In addition, the process of asset scouting, or search and evaluation, is not clear cut. The learning curve can be steep, requiring significant time in mastering how to conduct a thorough and effective asset search. For example, using the right search term can make the difference in finding a novel asset or nothing at all. And not every search term will yield success when searching across multiple commercial databases. It just takes time and experience to understand the strengths and shortcomings of each individual search engine and to become proficient at getting the most out of your searches.

But why would we need asset scouting?

Perhaps you already have a flush pipeline of potent and efficacious assets, excellent IP protection, and the intellectual capital and will to drive your programs to success. But there are advantages of having a search and evaluation function in your company:

- Risk Management. Assets identified for in-licensing can supplement a company’s drug development pipeline for future combination therapies or provide backup molecules in case of attrition of the lead program.

- Anonymity. You may be interested in seeking assets in a particular therapeutic area but would like to avoid alerting the competition of your asset interests. An asset scout from Alacrita can serve as a “middle man,” coordinating all communications while allowing your company to remain anonymous during the asset search and evaluation process.

- Competitive Intelligence. A sustained asset scouting effort provides a comprehensive picture of the landscape, enabling you to make investment decisions with more confidence.

- Public Relations. An increased flow of asset opportunities raises the profile of your company amongst academia and industry, thereby positioning your company as a “partner of choice” for future deals.

- Capital efficiency. It is possible that your internal team has spare capacity and bandwidth. By in-licensing a new asset, your risk can be diversified while leveraging your team and development infrastructure. In our experience, large investors like to diversify drug development risk within their portfolio, enabling individual portfolio companies to focus on a lead asset (while exposing the management to significant risk). Small to mid-size investors often welcome additional portfolio diversification, with portfolio companies having multiple “shots on goal.”

Asset scouting provides critical insight into the competitive landscape

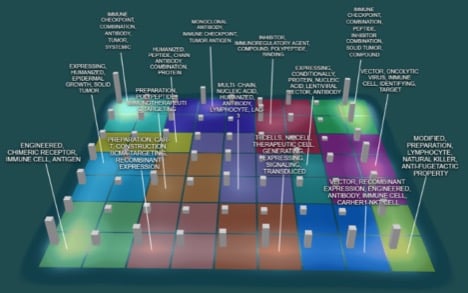

Is your company aware of every competitive asset currently under development for your targeted therapeutic area? Asset scouting is a valuable strategy for building a competitive landscape to benchmark your company’s assets vs. the outside world. An illustration of the immune-oncology (I-O) patent landscape is provided here that gives a snapshot of the current competition. Labels above each grid indicate the most prevalent keywords found in the associated patents and the bars beneath represent the quantity of related patents. A competitive landscape can be used to inform which therapeutic approaches are becoming hot, as well as those areas where there is potentially too much competition. From this I-O landscape, immune checkpoint inhibitors have clearly received significant attention as a therapeutic approach for oncology drug development. Is your lead candidate best in class, first in class, or likely to fail commercially due to a lack of differentiation? Asset scouting can enable you to answer these questions and enable informed strategic decisions to be made.

At Alacrita Consulting, we have significant expertise with supporting client companies in their in- and out-licensing efforts. We offer a search and evaluation team with experience across a diverse array of therapeutic areas, including oncology, inflammatory and fibrotic disease, immunology, infectious disease, gastroenterology, hepatology, urology, and reproductive and women’s health, to name a few.

Our search and evaluation consultants are former scientists, with significant training to identify assets and technologies that fit your company’s search criteria, understand the scientific hypothesis for the approach, evaluate the clarity of experimental data, and recognize the advantages of one asset over similar molecules. The greatest challenge is not in finding assets available for in-licensing but in sifting through the mountain of available assets to discover innovations that match a clients’ criteria and are unique and based on sound scientific work.

Couldn’t we just hire an internal search and evaluation professional rather than a consulting firm?

Depending on the therapeutic area, we identify most available assets in the first three to six months of a scouting engagement. Following this phase, asset search and evaluation transforms into a maintenance activity. This can entail follow-up on previously interesting assets that were too early in their development or identifying any new assets that have recently been advanced. The salary cost for an internal asset scout working for your company over several years is much greater than a six-month primary and secondary maintenance engagement with Alacrita. Especially given that we have a decade of experience, a comprehensive internal asset database, access to commercial asset databases, and existing relationships already established with hundreds of biotech/pharma companies and TLOs.

After suitable assets have been identified, the next step is gaining access to those assets, either through licensing, a joint venture, or acquisition, and Alacrita has the expertise to support you in this process as well. When clients do not have an internal business development capability, we can take full responsibility for defining the partnering strategy and objectives. We can also play a support role for clients’ internal capabilities and activities by assisting with deal negotiations, access to confidential data, review of client data to identify gaps, alliance management, or assist with the search for prospective partners. In addition, we offer support through all phases of drug development and can assist you with all your life science consulting needs.

Do you have a real-world example demonstrating the value of asset scouting?

Yes! If you read the financial news, you should know that GSK recently acquired Tesaro for approximately $5.1 B USD. Why is this significant? Because Tesaro’s pipeline was sourced through business development partnerships, collaborations, and in-licensing of oncology assets. Tesaro was able to identify unique oncology or supportive care assets and subsequently acquire or partner on the development and commercialization of those assets. Their drug pipeline, comprised of an FDA-approved PARP inhibitor (Zejula®) currently under evaluation in one phase III and five phase II studies, three additional novel drugs in phase I studies, and several more in discovery, is the direct result of possessing an effective asset scouting team.

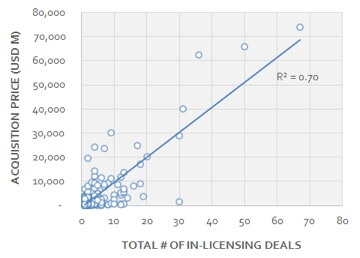

Tesaro is not the only company with significant in-licensing activities to benefit from a high valuation at acquisition. In the figure below, we plot acquisition price vs. total number of in-licensing deals sourced prior to acquisition. Out of 264 companies that were acquired for more than $100 M over the past 10 years, negotiation of a greater number of in-licensing deals prior to acquisition correlated with higher acquisition prices in the future. If you need further convincing of the value of asset scouting, you might be interested to learn that 91% of launched or registered drugs over the past 23 years were either in-licensed or acquired at some point during their development. Active asset scouting can translate into significant value for your company. If you don’t have an effective team, Alacrita can help.

Asset search and evaluation methodology needs to evolve as the industry changes

Your organization’s personal contacts and networks may have worked in the past, but future efforts will require an evolving strategy to maintain a competitive edge. A more high-tech approach to sourcing assets will be necessary to connect with the drug developers of tomorrow as the internet continues to make the world and every industry smaller. There are numerous online resources for identifying licensing and partnering opportunities such as online databases, virtual partnering forums, internet networking, and collaboration platforms. These resources can speed up the identification of novel assets and your company may miss out on a great opportunity if you are not taking advantage of them.

In addition, niche partnering events continue to expand. While there will always be a need for big partnering events such as BIO or JPM, those events are more focused on attendance and attracting big pharma. To identify truly unique opportunities and novel products, you will need to increase your attendance at the smaller events. But to adequately cover the increasing number of small partnering events, you will need a significantly larger business development capacity, which will increase costs.

Alternatively, why not take advantage of a global professional search and evaluation firm such as Alacrita? Our asset scouts already attend these niche events around the world, have a significant online scouting presence, and possess the scientific expertise to evaluate the quality of novel assets we discover. The assets of yesterday are unlikely to be discovered in the same places in the future and Alacrita is poised to help you find them.

For more information on our asset scouting services, please click here.