Respiratory Consulting Support

We support clients on a range of drug development products and programs targeting respiratory diseases, and advise healthcare investors and business development teams on individual assets, pipelines and companies in this promising space. Our core team draws from an extended consulting network containing over 50 senior consultants experienced with respiratory therapeutics. These specialists understand the unique and complex set of challenges present in their development and commercialization and can help you effectively navigate through them. Our extensive resources in this field allow us to field project teams that precisely match the expertise needs of each project.

The support we can provide ranges from opportunity mapping and business strategy to regulatory affairs, preclinical and clinical support, to due diligence, valuations and licensing, partnering & dealmaking, among other consulting service.

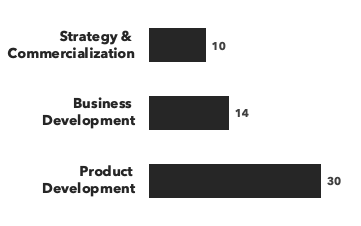

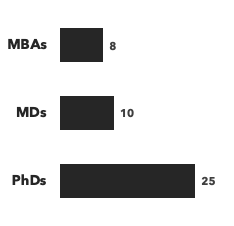

Number of consultants with respiratory expertise, by discipline and by education:

Recent Respiratory Consulting Projects:

- Assessing a new inhalation device and assisting with partnering: A medical device company has developed a nebulizer system for pulmonary delivery that can produce droplets below 1.5µm diameter. Initial clinical evaluations of demonstrator compounds used desktop prototype devices, and a handheld device with a disposable cartridge system was in development. They already had discussions with a number of pharmaceutical companies who had expressed interest in principle in the platform and were now interested in a systematic process to seek and establish one or more product-specific deals or even potentially a platform deal. Prior to that we recommended that they commission a gap analysis by an industry-experienced inhalation drug delivery specialist to assess their readiness for partnering.

- Clinical and regulatory support for respiratory delivery specialist: A respiratory delivery specialist company was looking at established drugs to assess the attractiveness and risks of developing inhaled or intranasal formulations of selected molecules. It had already filtered a long list of 100 potential projects to 50 and requested Alacrita's support from a pharmaceutical physician in order to winnow these down to a shortlist. In addition, the client requested biostatistical support to help develop suitable trial designs for selected projects.

- Valuation of a radiolabeled peptide for diagnosis of pulmonary diseases: In preparation for fundraising, a biotech company developing a clinical stage radiolabeled peptide to diagnose pulmonary diseases required an independent valuation of its technology in three indications.

- European market access support for clinical stage biopharma company: A clinical stage biopharma company developing a novel small molecule to treat a rare respiratory disorder had conducted an Advisory Board to finalize the design of later stage clinical studies for the asset. The Board wanted to understand the best positioning of the small molecule and particularly whether the clinical endpoints selected to date were sufficient for reimbursement approval. The company asked Alacrita to conduct a study investigating payer perspectives so that a robust clinical development strategy could be crafted for discussion with regulators, as well gain a preliminary understanding of the price range that could be achieved for the product.

- Providing in-licensing due diligence on a Phase IIb respiratory drug: A pharma company needed help conducting due diligence on an in-licensing/acquisition candidate for a Phase IIb respiratory drug.

Selection of Respiratory Consulting Case Studies

Challenge: A medical device company has developed a nebulizer system for pulmonary delivery that can produce droplets below 1.5µm diameter. Initial clinical evaluations of demonstrator compounds used desktop prototype devices, and a handheld device with a disposable cartridge system was in development. They already had discussions with a number of pharmaceutical companies who had expressed interest in principle in the platform and were now interested in a systematic process to seek and establish one or more product-specific deals or even potentially a platform deal. Prior to that we recommended that they commission a gap analysis by an industry-experienced inhalation drug delivery specialist to assess their readiness for partnering.

Solution: A respiratory drug delivery specialist in Alacrita's network critically reviewed the technology and conducted a gap analysis relative to the expectations of prospective partners. This was informed by his direct experience working in respiratory drug companies and many years of consulting to the industry. Our report highlighted the additional studies and developments that would be needed to bring the device to an optimum state of readiness for partnering.

Challenge: In preparation for fundraising, a biotech company developing a clinical stage radiolabeled peptide to diagnose pulmonary diseases required an independent valuation of its technology in three indications.

Solution: Previously, Alacrita had evaluated the peptide during its early clinical trial in one indication and developed a Business Plan to support the company’s strategy. We therefore begun the valuation exercise with a discovery session with the key management team to understand the current state of play of the asset, and any relevant inputs for the valuation model that had already been internally developed. These included target patient populations, peak market share and penetration, Phase 3 trial costs and timelines, and product pricing.

Using this information, we developed a valuation model for the radiolabeled peptide in each of the three indications, producing projections for addressable market and associated product revenues in US and EU5. There remained a level of uncertainty for some of the input assumptions such as sales growth and curve. While the product was considered first-in-class, more effective and cheaper to manufacture than standard imaging agents, giving it several advantages over standard of care competitors, it was recommended that a deeper analysis of competitive non-radioactive diagnostic modalities was also needed to validate the market share and sales growth assumptions in the valuation.

To address this, we developed a range of sales growth scenarios and used Monte Carlo simulation to capture ranges of input values (Min, Mode, Max) for all input assumptions. The output of the Monte Carlo simulation of the programme was risk-adjusted NPV (rNPV) expressed as a range.

Challenge: A pharma company needed help conducting due diligence on an in-licensing/acquisition candidate for a Phase IIb respiratory drug.

Solution: Our expert respiratory physician, who had a wealth of big pharma and biotech drug development expertise, reviewed the available documentation, including:

- Investigator brochure.

- Clinical study reports and publications of data from two completed clinical studies in a target indication.

- Clinical protocol and statistical analysis plan for the ongoing Phase IIb clinical trial.

- Assumption that all assets will be developed in parallel rather than prioritised in line with resource availability.

We concluded that the ongoing Phase IIb would have, at best, modest improvement in clinical performance and the drug would likely generate significant adverse events. We advised the client that in-licensing of the product should only be considered if the results provided more compelling evidence of clinical effectiveness than those available to date. The pharma company did not proceed with the transaction and the Phase II trial later failed to meet its primary endpoint.