CNS Consulting Support

We support clients on a range of CNS drug development products and programs, and advise healthcare investors and business development teams on individual assets, pipelines and companies in this promising space. Our core team draws from an extended consulting network, which has over 90 senior consultants experienced with CNS therapeutics. These specialists understand the unique and complex set of challenges present in their development and commercialization and can help you effectively navigate through them. Our extensive resources in this space allow us to field project teams that precisely match the expertise needs of each project.

The support we can provide ranges from opportunity mapping and business strategy to regulatory affairs, preclinical and clinical support, to due diligence, valuations and licensing, partnering & dealmaking, among other consulting service.

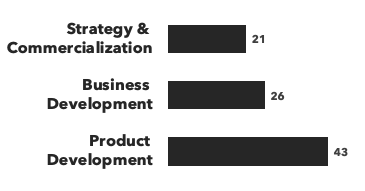

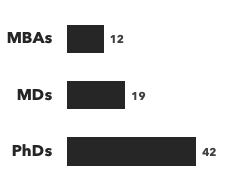

Number of consultants with CNS expertise, by discipline and by education:

Recent CNS Consulting Projects:

- Providing due diligence for an Alzheimer’s treatment: Our client, a major pension fund, was considering an investment in a Phase III neuroscience company, which was developing a small molecule to provide symptomatic relief of Alzheimer’s Disease (AD). Our client wanted to know the likelihood of clinical success in an ongoing Phase III clinical trial, therefore, one of our neuroscience consultants was selected to provide expert advice. Our consultant had significant experience in neurology, psychiatry and molecular neurobiology, as well as 20 years’ experience in drug development from first-in-human studies through multiple Phase III clinical trials, across a range of CNS indications. Most recently, he had been Chief Medical Officer and SVP in Drug Development at a neuroscience company.

- Development plan for a bio-scaffold in spinal cord injury: A leading US academic institution had created a therapeutics accelerator program to support early discoveries and facilitate industry partnerships of its assets. One of its internal projects was focussed on developing a bio-scaffold to enhance repair and regeneration following spinal cord injury (SCI). As part of an ongoing collaboration, Alacrita was commissioned by the University to perform a data gap analysis and to provide a roadmap of the necessary next steps to secure future investment.

- Scouting for Assets in CNS: An early-stage biotechnology company with several assets in pre-clinical development for CNS diseases wanted to supplement its internal pipeline with external innovation. The company wanted to use its proprietary technology to validate small molecule assets targeting distinct biological targets with a high degree of specificity. These assets ranged in developmental stage from 6-9 months pre-IND through Phase 1. The company was agnostic as to which indications the assets were developed for and hoped to develop their desired asset for a CNS indication. They engaged Alacrita to identify other potential partners and assets, with a particular focus in the US and Europe.

- Regulatory support for repurposed drug for ischemic stroke: Our client was working with a family office which had invested in a novel IV formulation of a repurposed asset for the treatment of ischemic stroke. With a promising completed phase II clinical trial and an ongoing phase III in Europe, our client was seeking to understand how the FDA would view this data, and whether any separate US trials or integration of US sites into the ongoing trials would be required to support the asset's approval in the US. They also wanted to understand whether they could obtain orphan drug designation (ODD) or any other approval that would allow for a faster approval in the US. Our client reached out for support in managing a pre-IND meeting with the FDA to discuss these matters.

- Critical analysis of third party valuation: Our client, a publicly listed biotech company, was considering a merger with another publicly listed firm. To further initial discussions, a third-party valuation was commissioned on the two parties. That valuation was conducted by a generalist accountant, and the client feared that the assumptions and methodology used did not adequately reflect industry best practice. The client asked Alacrita to conduct a rapid critical assessment of the third party valuation.

- Valuation of a novel drug for the treatment of symptoms of Alzheimer’s Disease: A clinical stage company developing small molecule treatments for CNS indications had completed successful Phase II studies for their lead asset. It sought to understand the potential value of its small molecule product for symptomatic relief of Alzheimer's disease. Alacrita was commissioned to produce an independent valuation to help the client understand the potential value of the product in the US and Europe.

- IP project evaluation for a natural product congener in Alzheimer’s disease for a US TTO: In an ongoing collaboration, a US technology transfer office required support in evaluating its life science research programs to help direct internal funding towards its most commercially viable projects. Alacrita was commissioned to provide a specialist commercial and technical assessment of a program developing a natural product for Alzheimer's disease.

- Preclinical gene therapy development support: A biotech company developing novel gene therapy approaches for in vivo cell trans-differentiation required an AAV gene therapy expert to serve on a scientific advisory board (SAB) tasked with ongoing analysis and development planning of preclinical studies for two lead programs.

Taking advantage of Alacrita’s extensive curated network of consultants, we were able to provide this client with support from a gene therapy expert with over 20 years of experience developing discovery to late clinical stage cell and gene therapies and regenerative medicine to serve on the SAB. Our expert provided advice and planning of the client’s preclinical AAV gene therapy programs, including recommendations for viral vector design modifications, experimental troubleshooting, translational study planning, technical data review and analysis, and input to preclinical study decision making to allow for the successful progression of each program to an IND.

Selection of CNS Consulting Case Studies

Challenge: Alacrita was engaged by a strategic investor to conduct initial due diligence on a novel observation and potential product opportunity in Alzheimer’s disease.

Solution: Alacrita’s Alzheimer's disease consultant reviewed the data available, both published and unpublished, and interviewed the client to clarify his understanding of the dataset.

The experimental data generated at the time of the due diligence exercise were intriguing and presented convincing evidence that the target molecules could be playing a role in Alzheimer’s disease pathology. The work had been conducted in transgenic mice but the therapeutic and diagnostic relevance of the data was not yet proven. Our opinion was that the biological insights could not yet be linked to Alzheimer’s progression and explained to the client that the path to generating convincing data would be long and expensive, probably requiring a large clinical trial. The therapeutic opportunities were not clear, with longer in vivo studies in a wider range of Alzheimer’s disease models to establish even preliminary proof of concept. The competitive landscape revealed a fairly large number of mainly early stage therapeutic approaches, with diagnostic potential of the technology needing to compete with CSF and amyloid level analysis and imaging technologies.

Moreover, the risk benefit balance was not convincing, with both diagnostic and therapeutic applications of the technology potentially exposing patients to risks of serious adverse events, some of which could be severe.

Our due diligence report recommended that the client proceed with caution given the very high levels of uncertainty around the science, the challenge of demonstrating specificity and selectivity as a diagnostic and the exploratory nature of the therapeutic nature of the program.

Challenge: A clinical stage biotech company developing treatments for Alzheimer's disease was looking for a valuation of its Phase II-ready therapeutic drug. The drug was a re-purposed combination of two known drugs with a well-documented safety profile, however unlike most other Alzheimer's drugs in development, it was part of a small pool of pipeline drugs that claimed to be disease-modifying, and in particular its primary aim was to stop disease progression at the prodromal/mild disease stage.

The company was looking for Series A financing of $30m in venture investment in order to progress the drug through a Phase IIa clinical trial. To prepare for discussions with investors, Alacrita was asked to develop an independent valuation of the drug.

Solution: Given the historical failures of Alzheimer's drug development and therefore lack of benchmarks for probability of technical success, developing a risk-adjusted valuation for this product was particularly challenging. Alacrita's Monte Carlo approach to pharma valuations proved to be useful in this case, as we were able to develop a valuation range that truly reflected the risk associated with Alzheimer's drug development whilst at the same time appreciating the potential value in a differentiated product with a known safety profile that could stop the disease at an early stage.

Challenge: Our client, a publicly listed biotech company, was considering a merger with another publicly listed firm. To further initial discussions, a third-party valuation was commissioned on the two parties. That valuation was conducted by a generalist accountant, and the client feared that the assumptions and methodology used did not adequately reflect industry best practice. The client asked Alacrita to conduct a rapid critical assessment of the third party valuation.

Solution: Our analysis of the indicated numerous areas of concern, including:

- Use of generic timeframes and costings for pharma R&D projects at different stages of development.

- Evidence that a risk-adjusted NPV analysis was not conducted properly; an unadjusted NPV was multiplied by a global probability of success which is not a valid approach.

- Market potential estimates with extreme values (in either direction).

- Assets described as "preclinical" stage but not differentiated between "hit" stage requiring hit-to-lead, lead optimisation and IND enabling studies versus IND-ready assets.

- Assumption that all assets will be developed in parallel rather than prioritised in line with resource availability.