Hematology Consulting Support

We support clients on a range of hematology drug development products and programs, and advise healthcare investors and business development teams on individual assets, pipelines and companies in this promising space. Our core team draws from an extended consulting network, which has over 70 senior consultants experienced with hematology therapeutics. These specialists understand the unique and complex set of challenges present in their development and commercialization and can help you effectively navigate through them. Our extensive resources in this space allow us to field project teams that precisely match the expertise needs of each project.

The support we can provide ranges from opportunity mapping and business strategy to regulatory affairs, preclinical and clinical support, to due diligence, valuations and licensing, partnering & dealmaking, among other consulting service.

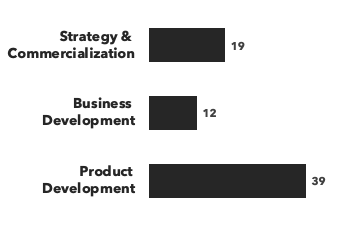

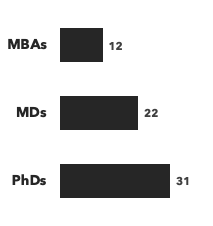

Number of consultants with hematology expertise, by discipline and by education:

Recent Hematology Consulting Projects:

- Valuation of Rx and OTC products for an investor: An investor and asset manager was considering an investment in a European biotech company with one development product for hemophilia and another approved OTC product in an unrelated therapy area. The investor was a non-specialist and required an independent valuation for the two programs to evaluate the attractiveness of the acquisition.

For the hemophilia product, Alacrita conducted a Monte Carlo simulation to express rNPV as a range and probability distribution. This model was used to account for the input assumptions carrying significant uncertainty. Alacrita projected the addressable market considering the target patient population, market share, drug pricing, clinical development timelines and costs, etc. Using this information, we estimated potential product revenue and considered the probability of success at each go/no-go development/regulator. Outputs of the valuation model also included histograms and tornado plots, the latter highlighting input parameters that drive the sensitivity of the valuation.

The OTC product valuation was generated using both a discounted cash flow and a comparables transaction analysis. - Primary market research and patient segmentation mapping in myelofibrosis: A venture-backed US biotech company was developing a preclinical biologic for hematological indications and wished to quantify the commercial opportunity for the product in treating myelofibrosis (MF). Alacrita was commissioned to perform an in-depth analysis of the current clinical treatment landscape and market in MF and identify the addressable target opportunity for the product.

- Opportunity mapping for hemojuvelin antibody: A US-based biotech company developing a novel biologic which impacts iron metabolism, wanted help deciding which disease and patient groups would make the best lead indication for development and commercialization. The company had already narrowed its shortlist of diseases down to three, based upon strength of scientific rationale. Alacrita was engaged to prioritize these based on commercial opportunity and development feasibility.

- Gap analysis for a CTA submission in the UK: Our client was developing a novel iron treatment with potential to be best-in-class for iron deficiency anemia (IDA). The product used nanotechnology to mimic the natural structure of dietary iron and promised superior absorption and a better side effect profile than commonly used oral ferrous iron products. The client was conducting a clinical trial in a developing country and wanted to know whether data obtained from that trial could be used by a commercial partner to support a market authorisation in the UK or in the US, or whether additional pivotal trials would be needed by regulators in those territories. The client also wanted to know whether the project could progress straight to a Phase II under current UK regulations based on the existing dataset or whether additional data would be needed to secure a CTA from MHRA.

- Commercial supply chain for US launch of a blood cancer drug: Our client was a publicly-traded clinical-stage biopharmaceutical company using an epigenetic approach modulate gene expression in tumor and immune cells to treat cancer. Their lead program was a small molecule inhibitor in late-stage clinical development for a hematological malignancy. In preparation for regulatory approval and launch in US, Alacrita was asked for support to help design and create a roadmap for setting up a commercial supply chain for the drug. The company had an upstream supply chain in place (API, DS, and DP manufacture), but no downstream elements yet in place.

- Commercial Development plan for beta thalassemia gene therapy: A leading European university identified a gene therapy for the treatment of haemoglobinopathies. Alacrita was asked to support the Principal Investigator (PI) in developing a Commercial Development Plan (CDP) to map out the opportunity and seek funding to progress the project to PoC stage.

- Deal analysis for an anti-anaemia product: An investor group was facing its first potential deal in the pharmaceuticals sector. It had pre-negotiated a deal with a group that had invented an approach to treating chemotherapy-induced anemia and urgently needed third party advice regarding the merits of the investment and the proposed deal terms.The initial scope of the assignment was to provide an independent expert view of the following items:

- The likely capital requirements over the lifecycle of the project;

- The potential commercial returns should the development of the drug(s) prove successful;

- The deal terms relative to industry standards.