Many valuation purists believe that a risk-adjusted net present value (rNPV) is the be-all and end-all of the value of a pharmaceutical asset. After all, it captures all the best insights into future revenues and costs and takes into account the key uncertainties to create a composite, objective view of value. Aside from the obvious issue of the calculated rNPV only being as good as the input assumptions (for which we use Monte Carlo simulations to capture key sensitivities), it ignores the dimension of whether anyone will actually pay that much for the asset in question, or indeed whether anyone will actually be interested in the asset at all. There are layers of market as well as asset-specific factors that modulate an asset's valuation in practice, and in extremis there is always a "sellability threshold", which if not met will fatally undermine the likelihood of any transaction. Looking back at valuation exercises we have conducted over the past 10 years, it will come as no surprise that many of the situations did not result in deal completion, whereas some completed substantially below or even above the median calculated rNPV value. What are the reasons for this?

Asset Quality

It is customary that the assumptions behind a valuation assume at least a reasonable standard of execution of an R&D project. This is not always borne out in practice, and it is usually beyond the scope of a valuation to conduct an in-depth due diligence of the asset and/or the development team. Even where this is done, and any discovered shortcomings incorporated into the probability weighting for the valuation, it may still turn out that the overall quality of the development does not match the standards of prospective buyers or licensees. In this scenario, there is a high rate of walk-aways from discussions for reasons other than the price of the potential deal.

Scarcity Value

Independently of the quality of an asset, its relative rarity will influence its value, reflecting the relative power of buyer and seller. For example, a new kinase inhibitor may well struggle to attract attention among the throng of current hopefuls and past candidates, whereas a novel MoA automatically overcomes this hurdle. Creating competitive tension is a key tactic for driving up value in licensing negotiations, and asset scarcity makes this much easier.

Motivated Buyer

Another factor is “Motivated Buyer”. In some cases, a deal driver is that company leadership has issued a strategic directive to ‘get one of those’, and their troops are incentivized to deliver. This tends to be, though not always, in hot areas.

Timing Issues

Investors, and management teams, are heavily influenced by fashion. One year, everyone is interested in cellular immunotherapy, the next year it's all about gene editing. Sometimes platforms are in vogue, other years it’s all about products. A high-quality asset may simply not resonate with the zeitgeist - it often seems to reflect the old saying that it's always too early until it's too late. Many deals don't get done simply because the timing wasn't right, not because of a valuation expectation mismatch.

Animal Spirits

Although the NPV purists talk of the rationality of the market, it is clear that animal spirits are as much a motivator as logic. The gyration of biotech stock prices over the past three years amply demonstrates this. In 2020/21, it was possible to complete an IPO for a preclinical stage company with a market cap in nine figures; the year after, the price cratered. This line of thinking underlies the use of market comparables, much beloved by the investment banking community.

Deal Likelihood Framework

The corollary of this is that deal price or valuation is separate from the probability of a deal going through to completion. Some of the factors that influence the chances of a transaction for a specific asset include the following:

- Stage in the financial cycle;

- Fit with current market trends;

- Asset uniqueness;

- Competitive threats (including indirect);

- Size of buyer universe;

- Execution quality;

- Transaction readiness.

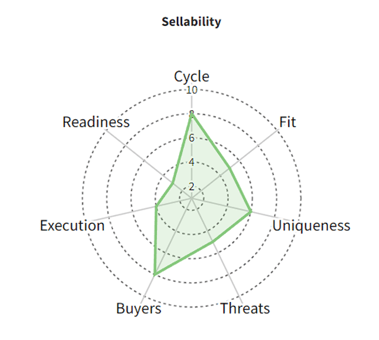

The parameters can be plotted on a spider chart (along the lines of the one below), and each factor can be weighted appropriately to produce a composite deal probability score.

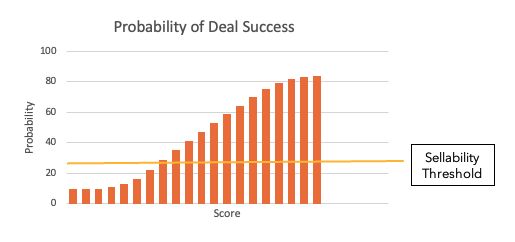

The "sellability" of an asset can be conceptualized as varying with this score roughly as shown below (any situation where the score is below the yellow line is highly unlikely to be doable).

Conclusions

In real life, licensing deals and acquisitions are transacted for sums which can differ substantially from objective rNPV valuations, both under and over. Therefore, in parallel with conducting an rNPV analysis and preparing the data-room, prospective licensors or vendors would be well advised to also conduct an assessment of the probability of concluding a deal to fine-tune expectations, both those of their investors' as well as their own.