Depending on your perspective, live biotherapeutic products (LBPs) are either a promising, newly emergent class of therapeutic agents that utilize live microorganisms to prevent or treat various diseases or are glorified probiotics with limited or at least unproven medical value. One of our clinical consultants told us that, outside recurrent C. difficile infections (rCDI), there seems to be an inverse correlation between how robust the clinical trial design is for LBPs and how impressive the results are. Indeed, attempts to deliver statistically significant data outside of rCDI have been challenging. Seres failed a Phase 2 trial in ulcerative colitis and 4D Pharma failed to deliver a signal in multiple placebo controlled trials across several indications.

We have conducted a substantial number of assignments focused on LBPs, including due diligence, CMC and regulatory support, as well as strategy and opportunity mapping. Here are some of our current views based on our experience in the field.

Probiotics Muddy the Field

There is a very significant food supplement market for probiotics and ‘gut health testing’, that, as unregulated products generally unsupported by evidence, cannot make specific health claims. Those that believe in the microbiome may argue that probiotics have shown some clinical benefit in treating necrotizing enterocolitis (NEC), a serious intestinal condition that affects preterm infants. Indeed, according to a 2020 Cochrane review, probiotics probably prevent severe NEC, reduce mortality, and lower the risk of invasive infection in preterm infants. However, the review also noted that the quality of the evidence was low to moderate, and that there was a lot of variation in the types, doses, and duration of probiotics used in different studies. Moreover, the review called for more large, high-quality randomized clinical trials to confirm the benefits and safety of probiotics for NEC. It may be that probiotics represent “diamonds in the rough”, but the mass of moderate quality studies, extreme variation in product compositions and strengths and the forest of pseudo-scientific information/disinformation on the web only serves to confuse the issue at best and to discredit the field at worst.

The LBP Field does not Operate in a Vacuum

Although the term is often used as shorthand for the LBP field, there is no Rx “microbiome market” per se. When considering any prescription LBP product, the most important assessment is of each product in the competitive context of all modalities of treatment, both established and in development, for the particular medical indication(s). It does not make sense to focus on the microbiome market, in the same way that, for a small molecule drug, one does not consider the “small molecule market”.

LBPs include traditional probiotics (live bacteria isolated from stool or fermented foods on the basis that they are easy to culture, isolate and remain stable), next generation probiotics (micro-organisms identified as having potentially beneficial phenotypic properties by in-vitro analysis in pure culture or by comparative microbiome analyses of healthy and disease burdened hosts) and genetically engineered LBPs, designed to enhance efficacy by inserting or deleting specific genes of interest). There are several approaches being championed, including:

- Classical intestinal microbiota transfer (IMT) from healthy donors in the hope that transfer of “healthy” microbial compositions will result in a therapeutic benefit. Early approaches involved IMT delivered by enema, which is in clinical use by select medical centres. These are typically delivered on a named patient basis under a hospital exemption.

- Processed and sometimes cultured compositions derived from stool donors, characterised for safety and elements of microbial composition, and delivered either by enema or in the form of lyophilised powder in capsule presentation;

- Selected individual microbial species, or defined consortia of up to 20 species, cultured using cell bank systems, and delivered as lyophilizates in capsule or other formats;

- Genetically single strains that have been programmed to perform a specific desired function or to deliver a therapeutic agent (synthetic biologics). A prominent example is T3 Pharma, recently acquired by Boehringer Ingleheim, that has developed a proprietary therapy platform that uses live bacteria to deliver immune-modulating proteins to cancer cells and tumor micro-environments;

- In addition, there are bacteriophage-based treatments and molecules/metabolites that seek to alter the composition of the microbiome in a beneficial manner.

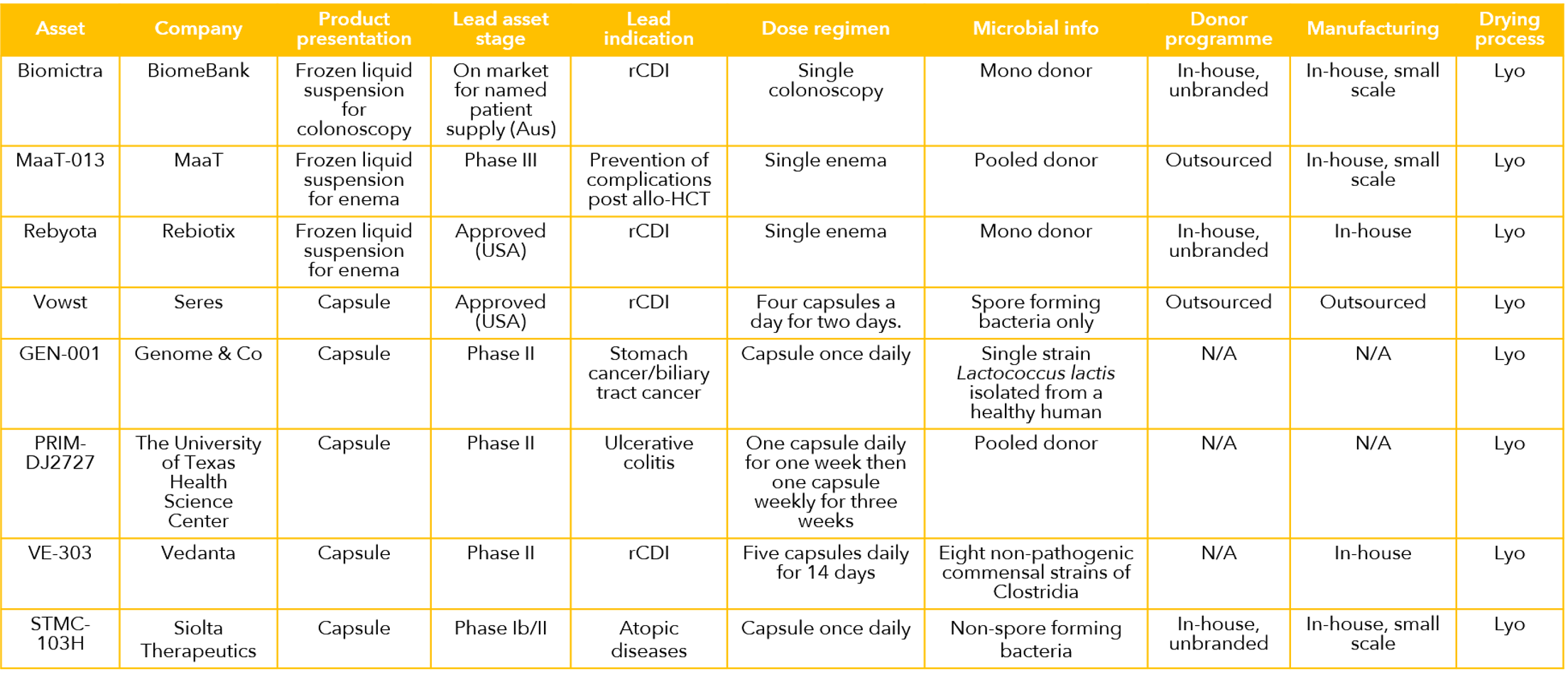

A selection of the leading LBP products and projects is shown in the table below. At the start of 2024, the field comprises two approved pharmaceuticals, (Rebyota and Vowst) and both are for treatment of rCDI. In addition, there is a host of projects in the R&D pipeline in a number of biotechnology companies and academic research groups. Furthermore, unregulated IMT protocols have been selectively incorporated into clinical practice by practicing physicians, almost all for treatment of C. difficile.

How Strong are the Clinical Data?

According to a review in the delightfully named Microbiome Times, there are over 100 clinical trials involving LBPs worldwide, with the majority focusing on gastrointestinal disorders, such as inflammatory bowel disease (IBD), irritable bowel syndrome (IBS), and rCDI. Other indications include metabolic disorders, such as obesity and diabetes, mental health conditions, such as depression and anxiety, and certain cancers. The data in rCDI have been strong enough to support two marketing authorizations, but data from all other indications are far less mature. The field is characterized by a large number of relatively small trials, few designed definitively with efficacy as a primary endpoint. There are encouraging early-stage and mid stage data, but it is still early days and it has to be concluded that the clinical evidence base has yet to reach critical mass outside rCDI. Despite the prevailing uncertainties, based on what we have seen in recent assignments, we have reason to believe that this may change for the better in the coming years.

The Microbiome is Arguably Even More Complex than the Immune System

The human intestinal microbiome is an extremely complex organ consisting of a highly diverse – and variable – ecosystem. Each person has a microbiome as unique as their fingerprint. Tools have been developed over the past decade or so that allow characterization of microbiome composition, most frequently through 16s ribosomal sequencing, although there are inherent biases in different methodologies that can skew results and, moreover, the technology does not distinguish between live and dead microorganisms. Numerous research groups have made retrospective correlations between assessments of microbiome composition and medical conditions and/or responsiveness to various therapeutic approaches, but there is no consensus in how best to harness this observation in an interventional manner.

To date, no one has been able to unequivocally determine a precise mechanism of action of any LBP. Indeed, the FDA Summary Basis for Regulatory Action for both REBYOTA and VOWS clearly states “The mechanism of action [….] has not been established”. Vowst induces a decline in proinflammatory Enterobacteriaceae species and an increase in Firmicute species, and the primary attribute of Vowst was identified as the restoration of colonization resistance in the gut and the metabolic competition between the microbiome therapy and C. difficile.

It appears that mechanisms of action of LBPs are based on competitive exclusion of harmful species by donor microbes with reduced toxin production or other positive attributes; other factors may include restoration of protective taxa and modulation of the recipient's microbiome by phage, donor microbes, or metabolites. However, in the context of a highly diverse and complex ecosystem, it is hard to assess whether an LBP will be sufficiently impactful on the composition of the microbiome. Indeed, there are few routes, other than clinical trials, to define what dose levels are needed to induce a positive result. When this is overlaid with the large variability of microbiome composition between individuals, and within individuals over time and in response to dietary, infection and other causes, the inherent complexity is extreme.

What Do Pharma and Investors Think?

LBP companies believe sincerely that managing gut microbe balance will have a profound impact on human health, but they may underestimate how hard it is to prove that in a controlled clinical setting. At one point, Big Pharma was showing reasonable levels of interest in the field, but this has waned. In the view of much of the pharmaceutical industry, because of lack of mechanistic understanding, the best that can be done is more empirical than they are comfortable with. Clinical trials are conducted in a diverse human population but based on preclinical data largely from inbred strains of rodents and observational studies of human microbiome correlates with disease. Whilst this is similar to standard drug discovery and development, there is insufficient mechanistic basis underpinning the LBP field even to determine which of the product formats (stool-based vs. defined organisms/consortia) will ultimately prove best. All of this tends to make Big Pharma uncomfortable – there may still be interest in the microbiome, but they want to see the data.

The gyrations of share prices of LBP companies and bankruptcy of others has tarnished the image of the space resulting in low levels of investment interest by VCs and Big Pharma. Beyond this, there is a plethora of “microbiome products” available on pharmacy shelves and the burgeoning probiotic drink and yogurt industry, which adds to the skepticism that physicians, pharma, and investors already have in the efficacy of the category and creates a market building hurdle for LBP Rx companies. With LBPs, perhaps more than any other field, largely because of the lack of understanding of a mechanism of action, confidence will only be properly established by more positive IIb/III trial results. That said, there are a handful of mostly specialty pharma companies that have embraced LBPs, which, with carefully selected investment and intelligent development, may emerge as leaders of a potentially blockbuster modality.

About the Author

- Anthony Walker, PhD, Managing Partner: Anthony leverages more than 35 years of experience, including over a decade spent building & managing a biotechnology company and over 20 years as a management consultant to the pharmaceutical & biotech industries. Anthony leads Alacrita's due diligence practice. Learn more

- Special thanks to Dr. James McIlroy, CEO at EnteroBiotix, for critical review and invaluable suggestions.

Our Expertise with Microbiome Drugs

We've consulted with clients on a range of microbiome drug development products & programs, and have advised investors and BD teams on individual assets, pipelines and companies in this rapidly evolving space.