For biotechs, how much is too much?

We’re all too aware of the rate of biotech company failures at the moment. This includes venture-backed companies that have raised well in excess of $100m, sometimes in a single round, especially in the U.S. Although Europe and the UK have not been immune, you’re still more likely there to feel the pain of underinvestment and corner cutting due to undercapitalization. Still, how can companies fail when they have plenty of cash? Could it be that a surplus can be toxic and that the dose-response curve for financing is bell-shaped?

Is this really still an issue?

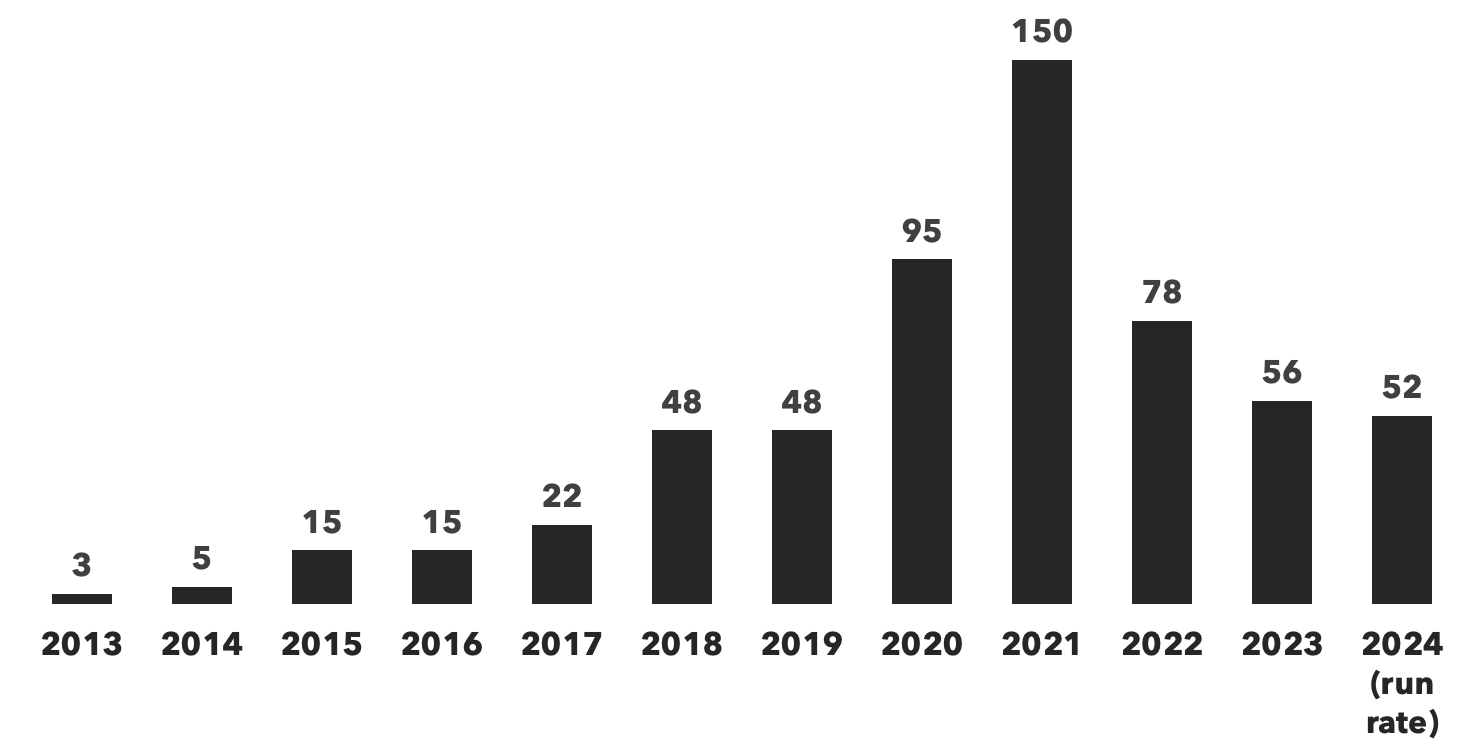

With so many cash-starved companies facing what has been a prolonged investment freeze, it may sound discordant to talk about “too much money” in the current environment. Actually, there have been quite a number of >$100m venture rounds, admittedly and not unexpectedly as many as during the COVID boom, with even the awful 2023 showing more than in 2018 and 2019 which were not considered bad years at all. And there are already indications that the investor foot may be back on the gas pedal in 2024. So, yes.

Count of Biopharma Venture Deals of $100 Million or More, 2013 - 2024

Source: DealForma and Stifel analysis

Why can too much money be toxic?

What mechanisms could lead to surplus money toxicity? Over-funding a biotechnology startup can result in a dilution of ownership for the founder and early employees. This can reduce their motivation, commitment, or alignment with the startup’s vision and mission. It can also reduce their influence or decision-making power over the startup’s direction and strategy. That said, in this type of case, too much is certainly better than too little.

More importantly, excessively funding a biotech can result in a loss of discipline for the company to manage its resources efficiently and effectively. This can lead to overspending, over-hiring, overpromising, or overexpanding without proper planning or justification. It can also lead to underperforming, underdelivering, or underestimating risks and challenges. And with higher levels of funding comes increasing pressure and expectations from investors. It becomes imperative to put all that capital to work, and to do it quickly and significantly. This can be especially problematic when an entity’s most attractive projects have already been funded and a decision is made to fill up the pipeline with additional projects, which can reduce the return on investment. Moreover, the larger the ship, the less easy it is to change direction, and so over-funded startups may lose strategic focus and agility. And as the team grows, so does the internal complexity and the accompanying office politics. The best-run startups we have seen are tight operations who have been conservative with their hiring, bringing on only the personnel absolutely necessary to get the job done. Everyone is reasonably stretched, but decisions are able to be made quickly and efficiently and there is a great feeling of satisfaction from achieving ambitious milestones. The precise opposite is engendered when there are just too many people around and a culture of wastefulness and complacency sets in.

How much is too much?

Too much funding can damage a biotech company’s wealth, or at least it’s value creation capacity. Fairly, it can be very hard to know what is excessive rather than just enough to get the job down with a bit of breathing room. In Europe and the UK, it’s emblematic to be working with too little – and it’s always best to take the funding when it is available, and as much as is accessible, as you never know when you can raise more. Though, arguably what we’re seeing now, clearly strengthens the case that it’s not how much you raise, but the way you spend it. After well over a decade of essentially free money, followed by the Pandemic boom, it’s fair to say a degree of discipline may have been lost and that that may be playing a role in the “correction” our industry has been experiencing.

Drawing up clear, concise, and focused business plans as if funding were your company’s limiting factor, designing teams with precision, and sticking to those plans even if available funding is ample is simply good business practice that should never be abandoned, regardless of resources. More is not always better - we’re not building empires after all - and the focus should only be on quality of team members and not quantity, while concentrating on mission-critical capabilities only. If you find yourself short of hands or expertise, you can always gap-fill with consultants. As the biotech funding markets open up again, by all means raise a mega round of finance, but use the money wisely and perhaps even be reasonably stingy. Not only will it keep your investors happier, but it may just make the difference in whether or not you succeed with the endeavor.

About the Author:

- Anthony Walker, PhD, Managing Partner, Alacrita Consulting

Anthony leverages more than 35 years of experience, including over a decade spent building & managing a biotechnology company and over 20 years as a management consultant to the pharmaceutical & biotech industries.

Learn more about Anthony