Everyone familiar with the risk-adjusted net present value method (rNPV) knows automatically that valuations decrease as the discount rate increases. This is indeed a fundamental tenet of the discounted cash flow (DCF) methodology. But is there anything else meaningful that can be observed? We took a look at a selection of valuations that we conducted over the past four years to see if there were any other insightful trends visible as we increased the discount rate.

Why are discount rates increasing?

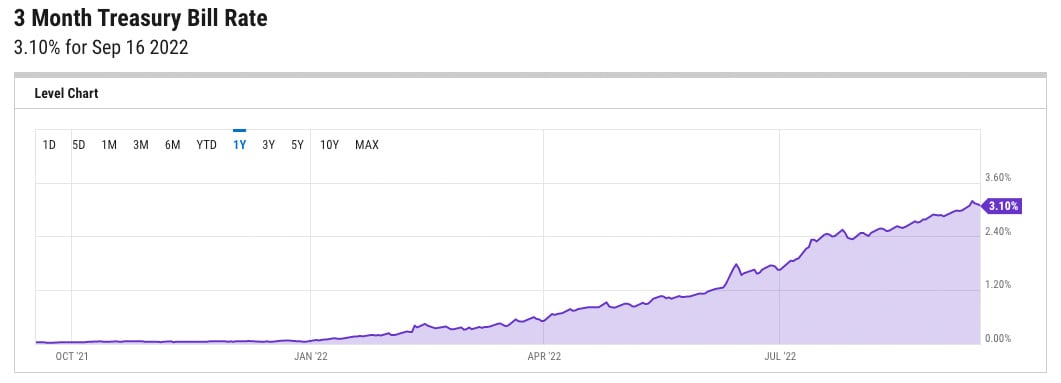

It is well understood that higher interest rates feed through into higher discount rates. As can be seen from the chart below, since the start of this year, the risk-free rate (represented by three-month US Treasury Bills) has already increased by 3.01%. The Federal Open Market Committee (FOMC) is widely expected to raise the federal funds rate further when it meets this week, most likely by 0.75%, though even 1% is possible. There is a general expectation that the rate will top 4% before the end of the year. As such, one can say that the risk-free rate has already increased by 3%.

Source: Y Charts

Source: Y Charts

For a typical biotech, with a 10% risk-adjusted cost of capital, that cost has therefore already risen to 13%. Alacrita has applied a 12% discount rate consistently in the past for biotech companies of a certain size/stage. With a 3% premium (given the increase in risk-free-rate) we are currently using a discount rate of 15%.

Effects on Valuations

Using a 15% discount rate, we re-ran a number of models that previously utilized a 12% discount rate. We chose a balance of the below criteria for our sample set:

- Early stage (preclinical) to mid stage (Phase 2) projects;

- Large indications (e.g. osteoarthritis, NASH) to smaller indications (e.g. niche oncology settings);

- Short time to commercialization (4-6 years) through longer (10-12 years).

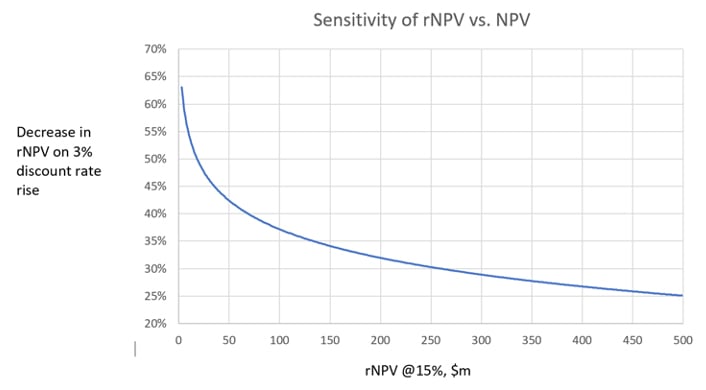

The decrease in rNPV caused by the three-percentage-point rise in the discount rate, ranged from 32% to as much as 70%.

What Drives Valuation Sensitivity?

Each of the projects in our sample set had its own dynamics, and although we saw some weak correlations, such as greater impact on rNPV with longer time to commercialization, for every association we thought we could observe, there were sufficient counterexamples to break the rule.

One trend, however, caught our eye: The relationship between the magnitude of rNPV and the percentage decrease in rNPV upon a 3% rise in discount rate, was non-linear (see chart). For rNPV values >$100m, there appears to be a relatively shallow, fairly-linear trend, but at rNPV <$100m, there is a more exponential correlation.

Conclusions and Implications for Fundability

Projects with modest rNPV, say below $50m, seem disproportionally sensitive to increases in discount rate (and by implication, to interest rates). Projects that appeared to give an acceptable ROI in the boom era (especially 2020-21), while interest rates were at an all-time low, may now appear unattractive or at best marginal. This highlights the needs to:

- Accurately cost and scope clinical trials

- Translate a TPP realistically into prospective pricing and market share

- Be rigorous in project prioritization/indication selection

We suggest that any project with an rNPV below $50m, possibly even below $100m, will become increasingly difficult to attract investment as interest rate pressure drives discount rates higher. Of course, we note that investors will almost never use rNPV as the sole determinant of pre-money valuations, but that’s for another blog post.

So we leave you with some questions. If this effect is real, what impact might this have on pharma and biotech pipelines, and the kinds of projects they contain? Or will the industry view higher discount rates as a temporary phenomenon, and stay the course?

About our valuation services

Our expert teams develop in-depth valuation models for our clients, helping inform strategic decision-making and investments.

Learn more