For over fifteen years, Alacrita has been an expert resource for due diligence and valuation services covering pharmaceuticals and biotechnology. This paper shares some of the insights we've learned during that time. For more information on our due diligence services, please click below.

The Basics

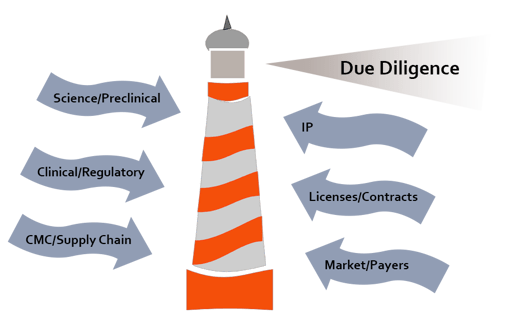

Due diligence, the formal exercise of quantifying risks and confirming value, has been described as “Art meets Science” and there’s a lot of truth in that. To some, it’s simply a question of working through a detailed checklist but that’s only a starting point. An experienced multidisciplinary team with availability under tight deadlines is a second essential. A skilled due diligence process leader with excellent cross-functional communication skills is the third. It is the duty of all target companies to provide accurate and candid information to the DD team (sadly, not all do this), but they usually have an inbuilt bias to promote the value and, while not deliberately obscuring the risks they may deemphasize them in presentations or bury them in a mass of detail. In this context, the essential intangible aspect, the ‘Art’ of DD, is the ability to apply a detective-like nose to root out opaque and unexpected issues that may not be apparent upon first or even second inspection.

Over the past seventeen years, Alacrita has conducted over 350 due diligence assignments, underpinned by our ability to draw in expert consultants who are active in each of the major disciplines involved in healthcare R&D. Each of our consultants brings previous experience within the industry, often spending decades in big pharma and biotech roles, and understand the mindset of the target companies and know where to look for the buried bodies. This complements the standard investor approach of interviewing academic KOLs who may be at the cutting edge of science and medicine, but who may lack the industry context. The following paragraphs draw on this decade of due diligence experience, highlighting some best practices we believe in and touching on some of the key pitfalls.

In Person or Virtual

Direct access to key management provides a much richer input and usually unearths more issues than a dataroom review alone. Timing, geographies and budget often do not permit the luxury of a site visit, but a videoconference or telephone call can be an effective substitute. When even this is not possible, it can pay to have the target company review a draft DD report (providing this doesn’t undercut a negotiating position). The target then has a chance to rebut findings or provide supplementary information and this can help sharpen the DD team’s conclusions. On occasion, we have been deliberately somewhat provocative in a draft report, and the tenor of management’s response can be highly illuminating – anything other than a reasoned, measured response by the target constitutes at least a yellow flag.

Expertise is the Key

Due diligence is not a task for a generalist; experience counts – when you have conducted 100 due diligences, this provides tremendous context for the 101st. Successful DD requires deep experience and high-level expertise in multiple functional areas focussed in an often narrow window of time and often under tight deadline pressure. Review of a clinical trial protocol and clinical trial data really needs experienced industry physicians who have done this sort of thing many times before and who have personally experienced both success and failure in clinical trials programs.

Staging the DD can offer significant process efficiencies. Having a small team conduct a ‘pre-DD’ can identify critical issues without the time and expense of a full documentation review and DD process. If any of the critical issues are showstoppers, the process can be truncated with material time and expense savings.

Common Pitfalls

So where are the bodies usually buried? Common issues we find in DD include:

- Not understanding the context of the buyer. You can only give advice if you understand the position of the person you are advising (e.g. a new Chinese fund may be prepared to take more risk as its setting out to establish its reputation; a big pharma may be looking to defend a valuable franchise, etc.). Always set DD recommendations into context;

- Target companies sometimes treat a DD exercise as an extension of the sales pitch – it is not. A promotional mindset is inappropriate here, rather DD must be regarded as a key part of the negotiation process. The common trap here is to polish the data and hide the negatives and this always backfires. We have experience where target companies ask us “what documents would you like to see”, aiming to keep our focus as narrow as possible rather than make all relevant information available in a transparent manner;

- Disconnects between management’s pitch deck and the contents of clinical study reports or FDA correspondence or other raw data (we have also seen discrepancies from these source documents to contents of SEC filings). Key lesson: never believe the PowerPoint;

- Mishandling of IP. Some target companies have a US-dominated perspective and some patent attorneys do not appreciate the differences between the USPTO and EPO rules and this can lead to problems downstream. Other problems can be generated when multiple patent applications on very similar subject matter have been submitted, sometimes leading to prior art issues and in the worst cases leading to contradictory arguments that can interfere with each other;

- The supply chain is often a blind spot for biotech companies working toward their first product launch as there can be an attitude that “it’s only manufacturing”. The reality is far more complex and commercial supply chain work needs to be initiated during Phase II trials. Without this, launch dates can be pushed back significantly unless there is the potential to supply the launch market initially with clinical trial supply material (a common assumption but often misplaced);

- Commercial viability. Understanding competition, points of differentiation, patient journey, market segments, standard of care, etc. are critical. Moreover, without payer input early on in development, there is a risk that a company develops a product with no market opportunity. In the worst case we have experienced, we conducted some payer and KOL research for a development candidate to get a feel for the likely pricing of the eventual product only to find that there were no circumstances where payers would reimburse the product and no KOL who would recommend prescribing it. It wasn’t that there was no medical unmet need, it was that the target product profile was judged to have little or no value in the real world.

- Technology licenses are not always in good shape. We have come across target companies who know they need access to third party IP but have taken the conscious decision to wait until they have proof-of-concept before approaching the third party for a license. This leaves them in a very weak negotiating position as the greater the value they have created, the stiffer the license terms will be. Chain of title for licensed IP is also key. In one situation, a company had licensed an invention from a university researcher and it wasn’t until the DD years later that we discovered that the university had not given its consent to the license and had rights that needed to be accommodated. Additionally royalty stacking, if not carefully managed, can severely compromise the value of an asset in certain circumstances.

- Soft IP assets – people (how good are they?, are they likely to stay?, etc) are often neglected in DD when of course they are essential for the success of any project or business. The exception may be when an asset is simply being transplanted into an existing mature organization, but even then ensuring continuity is almost always paramount.

Key Questions Checklist – Where to Start?

While a universal checklist would be difficult to apply to every scenario, any DD can start from the following sets of questions:

- What is the nature of the opportunity and what is the evidence supporting it? Is there sufficient differentiation from competition?

- Is the project/business truly in the condition that is being presented? Have any corners been cut, are there any gaps?

- What is the pathway to market and to value realization (two different considerations)? Are there alternative pathways? Is the right tradeoff between options (time to market, value potential, etc.) in place?

- What are the uncertainties on that pathway? How can they be addressed, how long will it take and how much will it cost? Is there scope for a ‘killer experiment’ to yield a definitive go/no-go?

- Is the organization/team up to the job?

Preparing for DD by the Target Company

Well prepared target companies have generally implemented the following good practices:

- Set up a good quality data room with all important documentation; keep this current on a real time basis. A well-defined structure in itself will highlight gaps that need to be filled by the company, and it’s better to do this as early as possible. The dataroom needs constant maintenance: many documents have a limited shelf life.

- Be critically aware of all key risks and consider risk mitigation strategies and responses to a due diligence team. Do not try to obscure risks, it’s always better to have declared them than let the DD team discover them for themselves.

- Have a sound understanding of the competitive landscape including potential infringers (both directions)

- Consider running a focussed internal DD process, preferably using an external DD team, before exposing the company to DD by investors, acquirers or licensors

Conclusion

Due diligence is not for the faint-hearted. It requires sufficient expertise and experience and a manageable process and timeline. Expert practitioners will, by virtue of all of the prior DD exercises they have undertaken, yield a superior result. Never use generalists for this specialized and essential task!

Alacrita's Due Diligence Services

Alacrita has been a dependable due diligence partner for close to fifteen years, bringing both the experience & expertise necessary to help our clients minimize risk, maximize value, and make informed decisions. therapeutic areas, product modalities, and business types.

For more information on our due diligence services please click here: Due Diligence Expertise